Alam mo ba?

...na ang kakulangan sa Healthcare ang isang malaking rason kaya nalulubog sa utang ang isang pamilya?!

Unfortunately...

-

nare-Realize lang ng karamihan na napaka-IMPORTANTE ng Healthcare kapag may sakit na, nasa hospital na, o nag-retire na.

-

Medical costs double every 5 to 7 years.

-

Maraming doctor at maraming gamot, pero bakit namamatay ang pasyente? Madalas, dahil WALANG PERANG pampagamot!

"HEALTH IS THE REAL WEALTH" - Sharon Cuneta

There are 3 Kinds of Healthcare

Short-Term Care, Long-Term Care, and Senior Care.

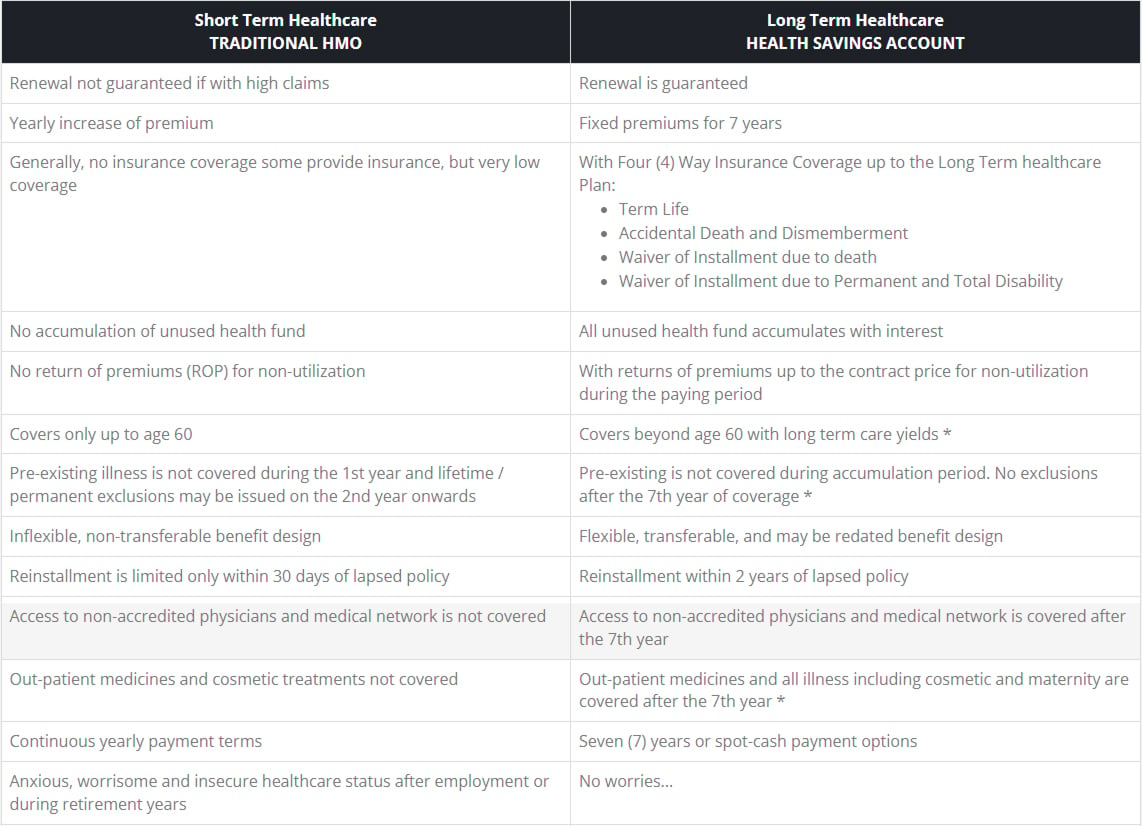

Short-Term Care

Ito ang healthcare na binabayaran taon-taon up to age 60 (magamit man natin o hindi).

Kapag nagpa-check up tayo o na-confine, sagot ng healthcare company ang bill natin. Kapag hindi natin nagamit, hindi carried over ang benefits the following year.

Kung empleyado ka, binabayaran ito ng kumpanya HABANG nagta-trabaho ka pa. Oras na mag-resign ka, o mag-retire na, hindi ka na covered.

Tanong: Kailan lumalabas ang mga mas seryosong sakit - habang bata, o kapag tumanda na tayo?

Long-Term Care

Ito ang healthcare na pwede nating simulan habang bata pa tayo, o habang hindi pa tayo Senior (10 to 60 years old).

Ito ang pinakamurang healthcare dahil pitong (7) taon lang nating huhulugan, pero covered tayo hanggang pagtanda.

Senior Care

Ito naman ang yearly healthcare for Seniors age 60 pataas.

Since alam ng healthcare companies na madalas nang magkasakit ang mga Senior, ito ang pinakamahal na healthcare.

The 3 Types of Healthcare

Watch Joen De Las Piñas and Noel Arandilla talked about the 3 types of Healthcare.

Which One Is Right For You?

Know more about your advantage with

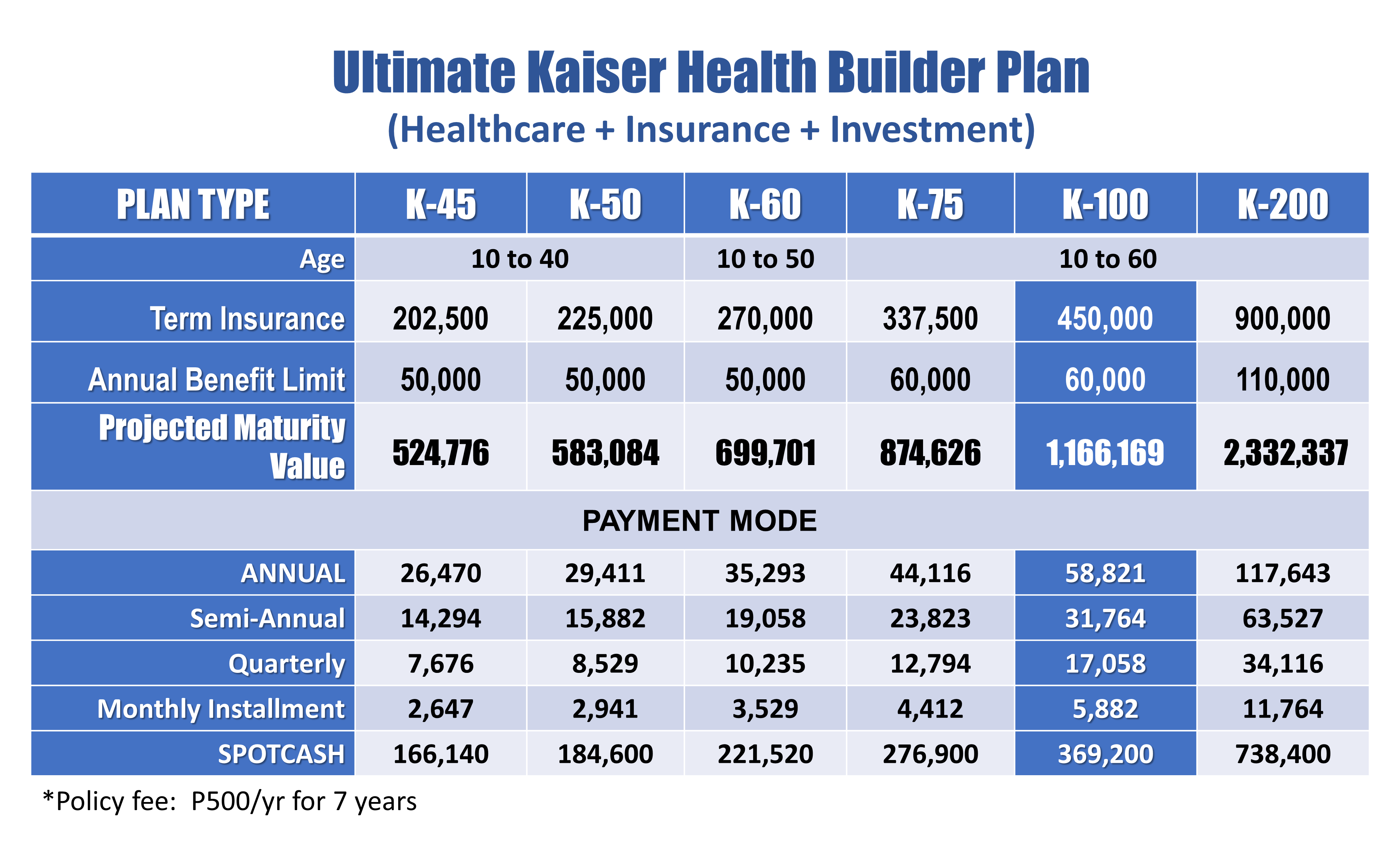

Ultimate Kaiser Health Builder Plan

Ano ba ang features ng Kaiser Long-Term Healthcare?

The KAISER Long-Term Healthcare is a 3-in-1 product.

Life Insurance

Covered tayo with Life and Accidental Insurance for 20 years, in case of untimely death.

In case the insured passes away during the paying period of 7 years:

1) The remaining installments will be waived.

2) The beneficiaries will receive the insurance proceeds.

3) At malilipat kay Beneficiary #1 ang policy. Siya na ang bagong owner of the plan. Wala na siyang babayaran. All investment and healthcare benefits, siya na ang makakagamit at makakakuha.

Healthcare

SHORT-TERM + LONG-TERM HEALTHCARE.

Kung magkasakit tayo NGAYON o pagdating ng ating SENIOR Citizenship, pwede nating gamitin ang Kaiser in all accredited clinics and hospitals nationwide.

Investment

Ito lang ang Healthcare Plan na nire-Reward tayo kung hindi tayo nagkakasakit. The Healthier we are, the Better because the More our INVESTMENT GROWS.

Once our plan matures at the end of 20th year, pwede natin i-withdraw, o iwanan lang ang pera para tuloy-tuloy lumago for our Long-term healthcare needs, or source of Retirement Fund (Passive Income).

Watch this video

Learn HOW Kaiser Long-Term Healthcare works.

In Kaiser Long-Term Care

You can build

a SOLID FINANCIAL FOUNDATION.

Have the Complete Financial Solution

Alamin ang "ipon na walang tapon"

KAISER PRE-COMPUTED TABLE